What Is Credit And The Importance Of Checking Yours

What Is Credit

Credit can be defined as the ability to borrow money or accessing goods and services with the understanding that you’ll pay up later. The concept of credit is not something new and many people have used it in different ways. It can further be defined as the art of receiving value now with a promise of paying up later.

How Does Credit Work

Over time, creditors have been judged by their reputation and creditworthiness. This method was susceptible to error bias and manipulation. Nowadays, creditors usually prefer a more objective approach. In the United States, your credit history plays a vital role. This simply means your record of borrowing and repaying funds. This is usually very significant in determining whether to issue you credit.

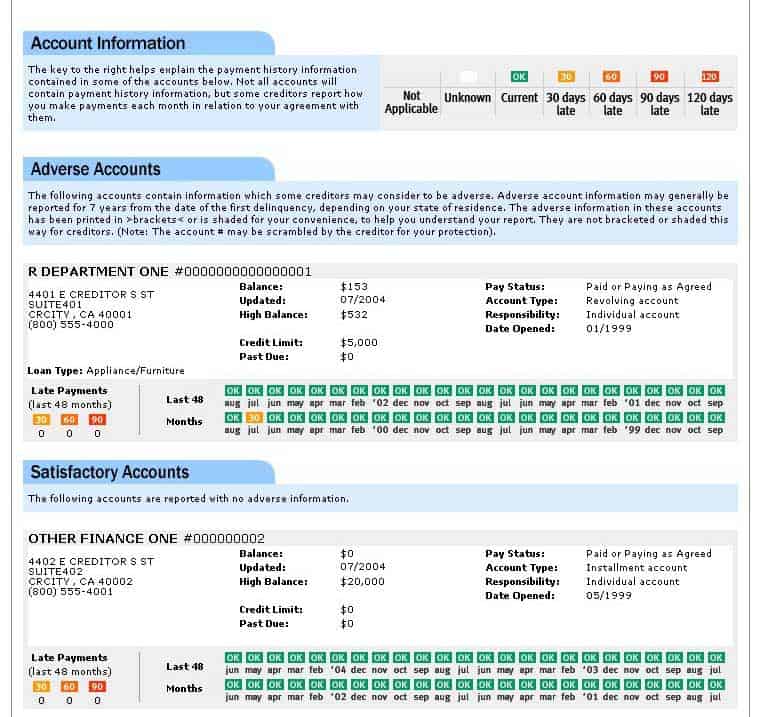

So your credit history is usually summarized in filed known as credit reports. These files are usually compiled by three independent credit bureaus which include the TransUnion, Experian, and the Equifax. Normally, credit card issuers, banks, and credit unions voluntarily report your borrowing and repayment information to these credit bureaus.

So What Is Included In Your Credit Report

-One of the things included here is the amounts of loans you’ve taken and how much of it you’ve already paid.

-The number of credit card accounts you have and each of their borrowing limits as well as their current outstanding balances.

-Some other information included here is the setbacks you have on your credit which may include mortgage foreclosures, bankruptcies, and car repossessions.

-It also includes information such as the amount of any loans you’ve taken and if they were made in time.

All this information is used to give you a credit score. Your credit score normally distills the information on your credit report making it easy to interpret. This is done in a fair way minimizing any possibility of bias.

Why It Is So Important To Check Your Credit

We are all aware that are used to make major decisions regarding our financial future. This includes employment opportunities, insurance rates, and the ability to rent a home or buy one, getting a car loan. Here are a few reasons why it is important to check your credit and the common things to look for when reviewing it?

-Ensure that the report indicated in the report is accurate. You may find out that a credit report contains errors. Surely you wouldn’t like an error to prevent you from getting an awesome rate for a home loan, car loan, or a credit card for sure.

-It is also important to review your credit report and ensure that your accounts have been properly recorded in your report. If indeed you are always paying on time, you should not find late payments recorded on your report.

-The fact that you know what the lenders are looking for is very critical. For instance, if you are applying for a loan or credit card, you should be aware of what is in your report even before the lender asks for it. Knowing what is in your report enables you to answer any questions regarding information which is contained in your report.

-Another important thing about checking your credit report is protecting yourself from identity theft. When reviewing your credit report, pay keen attention to:

. Collection of credit accounts that you do not recognize

. The names or addresses which are not familiar to you.

. Enquire to see your credit report from some creditors whom you never authorized. There are those creditors who will look at your credit for them to offer you credit. In case you see this type of inquiry on your credit report, ensure that you check the account section of the credit report and see if an account was surely opened. Click here to get a $1 trial for 7 days to make sure your identity hasn’t been compromised or being used by someone else.

Why You Should Join Credit Karma

The best way of understanding and reviewing your credit score and report is by joining Credit Karma. Credit Karma is known to offer its consumers with credit scores as well as other credit associated information from credit bureaus such as Equifax and TransUnion. It also offers consumers with tools such as an app and guides on how to improve their ratings. The Good thing about Credit Karma is that users can access the information they want freely and also as frequently as they want. All this can be done without even registering a credit card. Click here to get your free credit scores.