greatestbusiness1

How Bad Credit Affects Your Credit Score

What Is Your FICO Score

One of the first known credit scoring services was known as FICO, originally Fair, Isaac, and Company. The company was founded in 1956 by Bill Fair and Earl Isaac as a data analytics company based in San Jose, California. Its FICO score gave a measure of consumer credit risk and became the fixture of what lenders use to analyze consumer risk factors.

FICO scores range from 300 to 850, and a score of 670 and above is considered to be a good credit score, while a credit score of 800 and above is considered to outstanding. Now in the 21st century, things have most certainly changed. A low FICO score will make it difficult for you to get anything on credit with a decent interest rate. Unless you are willing to pay upwards to 30% in some cases, a low FICO score is not only bad for you but will cost you more than 3 times what the average person with good credit will pay for the same purchase.

Who Keeps The Credit Scores

There are 3 major companies that keep what is known as your credit files. The 3 major companies or credit bureaus are Equifax, Experian, and Transunion. Each one of these companies asks for every line of credit extended to you be reported to them, along with how you make your monthly payments, the accounts you have open with different companies, and who requests to view your credit history. They also want to know of any public records against you such judgments, bankruptcies, or closed accounts with their payment history as well.

There are other companies that keep up with your public information, but they are not used to keep a credit score. The most notable of these is called LexisNexis. These companies are more used when you are searching for insurance quotes or certain types of credit cards that have a no credit check.

These reports usually show all the items on your credit report, along with other personal information, most notably, your insurance information. They will show when you had claims, when your insurance started, ended, the reasons for service ending. Did you lose insurance due to non-payment? This is how other insurance companies always no. LexisNexis always keeps up with every address, phone number, email address, and just about everything else you would consider to be personal information.

Scores That People Receive From Their Credit Reports

Each of the 3 major bureaus issues a score between 350 and 850. A credit score over 720 is considered to be a good credit score and above 750 is considered to be in the great credit range. Below a 650 score is now considered to be sub-par credit. Having a score below 580 makes it very difficult to purchase anything using a line of credit.

It is important to understand what factors play into the generation of your credit score. While there is no specific order as to how they score, these are the major factors that are considered when your score is generated:

- Credit age or how old your oldest piece of credit is. Companies like to see if you can keep an account open for a long period of time. While paying on time each month. The longer you have credit open, the more your score will start to rise. Typically, getting credit over 5 years old is considered to be good, and getting up to the 10-year-old range with no late payment is considered, great.

What Are The Three Major Types Of Credit

Credit scores are utilized by credit card companies, banks, car dealerships, mortgage companies, and a host of other financial institutions in the business of loaning money and issuing credit. The most common types of credit accounts are revolving credit, which are credit cards or store cards. The other is an installment account, one in which you make payments to the overall price of the item. Most notably these are for motor vehicle purchases. Lastly, real estate accounts which cover home loans. Although there are other types of credit these are the major types. Bureaus like to see that you have accounts of all types when issuing high credit scores.

How Your Credit Utilization Stacks Up

So how you use these credit accounts is the next major factor in determining your scores. This is called credit utilization. It’s simply how high you keep debt. Credit companies like to see you use less than 35% of your available credit. The higher the balance you keep per account, the lower your score will be.

The Importance Of Payment History

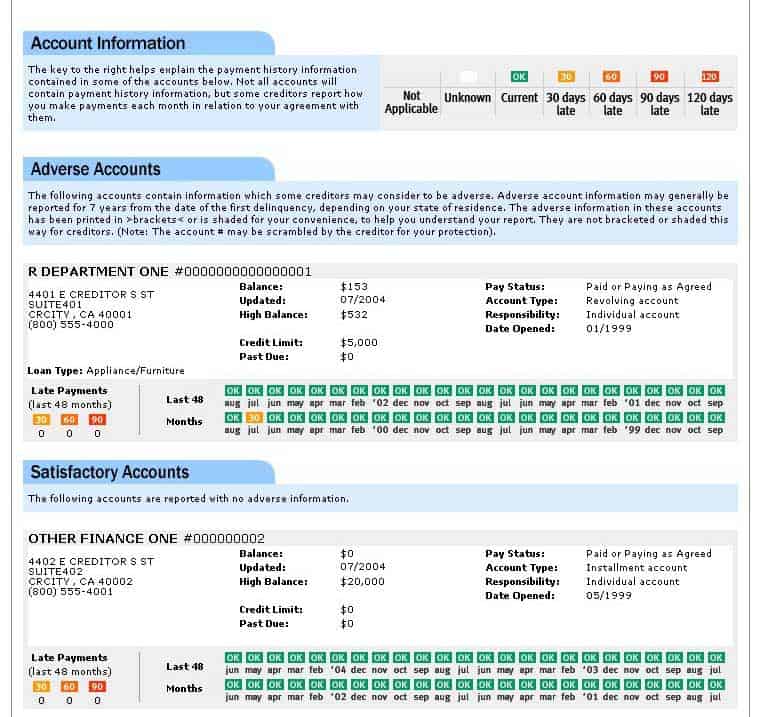

Payment history is very important when it comes to the last factor as well. If you have a diverse group of credit and accounts that are old, and you have not paid them on time, your score will suffer. Credit payments are listed as either on time, 30, 60, 90, or 120 days late. If you fail to make your monthly payments, your creditor will list the as a charged off. Each one of these negative marks will drastically bring down a credit score. Charge off means, that company has actually stopped collection attempts, closed your accounts, and sent it to legal (which is a department when lawyers are involved) to come after their money. A lot of times, these debts are actually sold and issued to a new debtor who can actually report it again as bad debt and hurt your credit score again.

The Cost Of Bad Credit

Yes, there is a price to pay for having bad credit. Missed payments, late payments, and failure to pay have its consequences, unfortunately, they are negative when it comes to your credit scores. It already limits your ability to get things on credit and when you do get accepted credit, it’s at an extremely high-interest rate. Take a look at the numbers and see where you would fit in with your credit scores and how the point system works on your credit.

- Exceptional Score 800 – 850

- Very Good 740 – 799

- Good 670 – 739

- Fair 580 – 669

- Very Bad 579 – 300

- Hard Inquiry – decrease up to 15 points lost

- Late Payment – decrease up to 100 points lost

- Collection – decrease up to 110 points lost

- Debt Settlement – decrease up to 125 points lost

- Foreclosure – decrease up to 160 points lost

- Bankruptcy – decrease up to 240 points lost

Inquiries

Finally letting companies see your credit can impact your scores and bring it down as well. This is called an inquiry. When you are trying to make a purchase or get qualified for credit cards, your scores are impacted each time one of these companies requests a copy of your report from the bureaus. Having under 3 inquiries on your credit profile at any time is ideal.

What Type Of Effect Does Credit Have On Your Daily Life

So we know how our scores or calculated but how do they have an effect on your daily life? Well, they have a huge effect on daily life and it’s all about how having bad credit can cost you. First of all, bad credit is embarrassing and it affects your dignity. If you are going to a department store and are asked to sign up for one of their credit cards for a discount but when you have bad credit, you know you can’t sign up because you will be declined on the spot because you know you have bad credit. If you have bad credit and you need a loan for any purpose, click here for Trusted lenders ready to serve you.

Even when you are shopping for a car, not only will bad credit affect the type of car you can purchase, it will also affect how much money the vehicle will ultimately cost you. Car dealers may offer no money down deals and 0% financing on certain cars but no for bad credit customers. When car shopping with bad credit, most lenders will want you to put a large percentage down, along with interest rates in the upper 20% range. This is considered to be risk-taking for the car dealership but can be life-changing problems for the consumer. When receiving a single digit interest rate, an average $30,000 dollar car payments can be well under $700 dollars but if you have to pay a high-interest rate and are only offered a short term, your payment can be closer to $1,000 per month and drastically change your monthly budget. You usually end up looking for a less expensive car.

What Is Credit And The Importance Of Checking Yours

What Is Credit

Credit can be defined as the ability to borrow money or accessing goods and services with the understanding that you’ll pay up later. The concept of credit is not something new and many people have used it in different ways. It can further be defined as the art of receiving value now with a promise of paying up later.

How Does Credit Work

Over time, creditors have been judged by their reputation and creditworthiness. This method was susceptible to error bias and manipulation. Nowadays, creditors usually prefer a more objective approach. In the United States, your credit history plays a vital role. This simply means your record of borrowing and repaying funds. This is usually very significant in determining whether to issue you credit.

So your credit history is usually summarized in filed known as credit reports. These files are usually compiled by three independent credit bureaus which include the TransUnion, Experian, and the Equifax. Normally, credit card issuers, banks, and credit unions voluntarily report your borrowing and repayment information to these credit bureaus.

So What Is Included In Your Credit Report

-One of the things included here is the amounts of loans you’ve taken and how much of it you’ve already paid.

-The number of credit card accounts you have and each of their borrowing limits as well as their current outstanding balances.

-Some other information included here is the setbacks you have on your credit which may include mortgage foreclosures, bankruptcies, and car repossessions.

-It also includes information such as the amount of any loans you’ve taken and if they were made in time.

All this information is used to give you a credit score. Your credit score normally distills the information on your credit report making it easy to interpret. This is done in a fair way minimizing any possibility of bias.

Why It Is So Important To Check Your Credit

We are all aware that are used to make major decisions regarding our financial future. This includes employment opportunities, insurance rates, and the ability to rent a home or buy one, getting a car loan. Here are a few reasons why it is important to check your credit and the common things to look for when reviewing it?

-Ensure that the report indicated in the report is accurate. You may find out that a credit report contains errors. Surely you wouldn’t like an error to prevent you from getting an awesome rate for a home loan, car loan, or a credit card for sure.

-It is also important to review your credit report and ensure that your accounts have been properly recorded in your report. If indeed you are always paying on time, you should not find late payments recorded on your report.

-The fact that you know what the lenders are looking for is very critical. For instance, if you are applying for a loan or credit card, you should be aware of what is in your report even before the lender asks for it. Knowing what is in your report enables you to answer any questions regarding information which is contained in your report.

-Another important thing about checking your credit report is protecting yourself from identity theft. When reviewing your credit report, pay keen attention to:

. Collection of credit accounts that you do not recognize

. The names or addresses which are not familiar to you.

. Enquire to see your credit report from some creditors whom you never authorized. There are those creditors who will look at your credit for them to offer you credit. In case you see this type of inquiry on your credit report, ensure that you check the account section of the credit report and see if an account was surely opened. Click here to get a $1 trial for 7 days to make sure your identity hasn’t been compromised or being used by someone else.

Why You Should Join Credit Karma

The best way of understanding and reviewing your credit score and report is by joining Credit Karma. Credit Karma is known to offer its consumers with credit scores as well as other credit associated information from credit bureaus such as Equifax and TransUnion. It also offers consumers with tools such as an app and guides on how to improve their ratings. The Good thing about Credit Karma is that users can access the information they want freely and also as frequently as they want. All this can be done without even registering a credit card. Click here to get your free credit scores.

Credit Qualifications For A Home Loan

If you are planning to secure a loan to buy a home, then your credit score is a significant factor to determine your loan approval. The credit score helps the lender to evaluate your ability to pay off the debt in due time. It is thus important to know the credit qualifications needed to secure a mortgage to help you move successfully through the approval process. The minimum credit score, however, varies depending on the type of mortgage that you are applying for.

Credit score qualification by mortgage type

• FHA loans usually have the lowest credit qualifications, and if you are not well up at the moment, then this type of mortgage is an ideal option to consider. For the FHA loan, the lender will require a 500 credit qualification with a 10% down payment of the mortgage.

• USDA loan is a bit expensive and will require a minimum credit score of 640+ for most lenders.

• VA loan has a 620+ credit score though some lenders may just require about a 580 score.

• A conventional loan is similar to the VA loan with a minimum credit score of 620+.

Your credit score will affect the interest rate you will be required to pay during the loan repayment. Usually, poor credit qualifications attract more interest rates and this, in return, increases the closing costs prompting you to make higher monthly payments.

If you are approved for a mortgage with a 579 credit score, you should expect a 2% higher interest rate.

580-619 credit score a 1% higher interest rate.

680-739 credit score will not be affected by the change in the interest rates. It is the range for many investors.

With a 740+ credit score, you will enjoy the best interest rates from different lenders.

If you need to get your home loan approved, then you need to increase your credit qualifications. Click here for a 7 day $1 Credit Score Trial and make sure your scores will not only help you get the mortgage but also let you enjoy the lower interest rates charged by the lenders.

Credit Qualifications For A FHA Loan

Are you thinking of securing an FHA loan to buy a home? Well FHA loans are quite appealing, especially for first-time borrowers with low credit scores and young credit history. The FHA loans are also preferred by experienced homeowners who are not financially stable due to the low credit qualifications required to secure a mortgage.

Credit qualifications for an FHA loan

FHA loan has the lowest credit score requirements for all borrowers who need to secure a mortgage. With a credit score of at least 500, you can get an approval for the FHA loan. However, there are some drawbacks you are likely to experience with these low credit scores.

• You will be required to pay a 10% down payment as you secure the loan.

• The low credit scores attract higher interest rates of about 2% higher than the normal rates. This is a result that becomes so expensive to manage, and you may end up paying a lot of money on the monthly installments and on the interest rates charged and the loan repayment as well.

Increasing your credit score can thus be an ideal way to evade the extra expenses and helping you enjoy the mortgage at lower interest rates. You don’t want to find yourself in a position where you’re applying for credit to get the home of your dreams and find that your identity has been stolen and your credit scores have been ruined. I recommend that you can get your credit scores from all 3 credit bureaus (Equifax, TransUnion, and Experian) and Identity Theft Protection here for a 7 day trial for $1.00.

Benefits of higher credit qualification

You will get more lenders competing to get you a loan at a lower interest rate.

You will also enjoy lower down payments of about 3.5% once you secure the loan.

FHA loans are indeed a great deal to consider if you have a low credit score. However, you will need to increase your credit qualifications to enjoy better interest rates for the mortgages. You also need to maintain a good credit history to secure an FHA loan. Ensure that you understand the loan terms before you can move forward to signing the loan. Simply go for what you can comfortably afford.

Credit Qualifications For Leasing A Car

If you are planning to lease a car, then you need to ensure that you meet the credit qualifications to lease the car. If you are not sure of the credit score required in leasing the car, then this simple guide should help you get a clarification on the loan terms.

Credit qualification for leasing a car

• Usually, a credit score of about 620+ is required to lease a car. This is quite affordable for many borrowers. However, a low credit score attracts higher interest rates, and you could end up incurring huge costs during the loan repayment.

• Credit scores ranging from 620 to 680 attract a 5% higher interest rate. You may also be required to pay a large down payment or a deposit on the car lease.

• Credit scores above 720, on the other hand, qualifies for the best interest rates. Banks and other financial lenders will be competing to get you a lease at favorable terms.

Financial lenders may reject the lease applications if your credit score is quite low. Banks require you to have a good credit history and a higher credit score to evaluate your ability to repay the car lease. If you have a poor credit history or a bad credit score, then you may get a relative or a close friend to sign the loan on your behalf. This can help you get the lease approved at favorable terms.

Improving your credit qualifications is thus an excellent idea to get favorable conditions while applying for a car lease. Your repayment history, balances in your bank accounts, the time you opened the bank accounts, and the number of times you have applied and repaid loans in time significantly determine your credit score. It is thus important to pay attention to such factors to improve your credit scores.

Click here and get up to $4000 by tomorrow and it does not affect your credit score and you can be approved on the same day.

Thank You

thank you for joining…be sure to accept emails from info@qualifications.com for special offers

Click Here To Get Your Free PDF

Bonus Tip: If You Want To See Your Credit Score Now, I Highly Recommend You Try a $1 Credit Score Trial.

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!